Hey there,

Welcome to another issue! I completely overlooked this with everything else going on, but last week’s issue marked the one year anniversary of writing Climate Tech Canada 🤯

It’s been a real blast writing this and getting to know the climate tech ecosystem across Canada over the past year. I deeply appreciate you subscribing and taking the time to read - it means a lot.

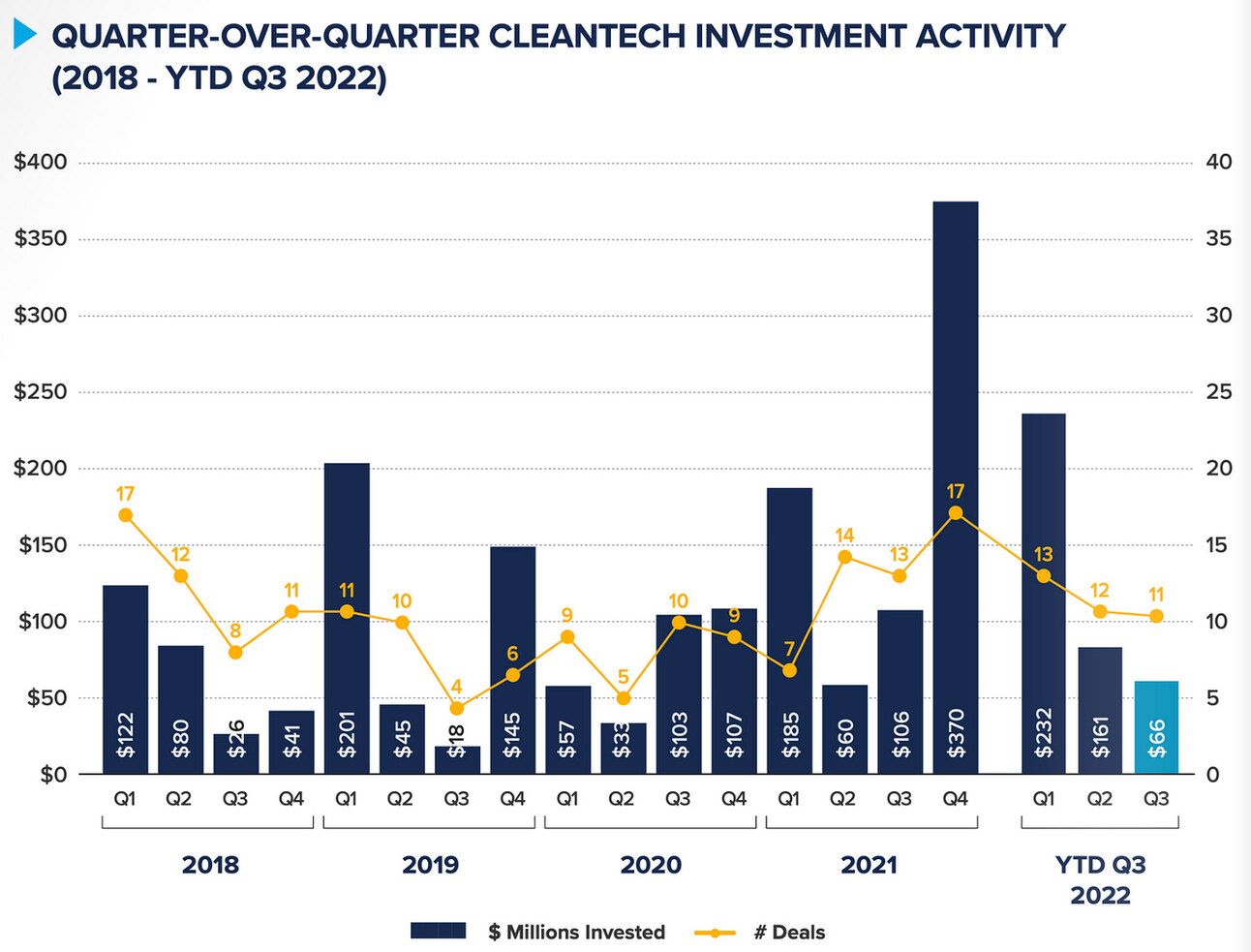

This was a particularly wild year for tech generally, but it marked another strong year for climate tech investments. Even in the middle of an overall slowdown in funding activity, investment in Canadian climate tech already exceeded 2020 levels at the end of Q3.

Source: CVCA

It’s an exciting time for climate tech and I’m looking forward to telling more Canadian success stories in the year ahead!

In this week’s issue, we have a ton of new funding for railway analytics, energy-as-a-service, and more. In the news, GM’s first Canadian-made EV vans rolled off the assembly line, the feds introduced their national climate adaptation strategy, and a whole lot more. Let’s get into it!

Funding and growth

GoBolt (Toronto, ON) closed a $75M Series C round to fuel growth in existing markets and grow their fleet of EVs. GoBolt offers low-carbon fulfilment and last-mile logistics in Canada and the US.

RailVision Analytics (Montreal, QC) closed a $5.5M seed funding round for its rail optimization technology. RailVision’s tech helps rail operators optimize their driving, reducing fuel consumption and emissions. RailVision will use the funding to grow their team, expand the product offering and acquire new customers.

“It’s an industry that things just show up on their doorstep and they have no clue how it got there, but it’s responsible for moving more or less everything around”

- RailVision CEO Dev Jain

UgoWork (Quebec City, QC) raised $22.8M in Series B funding for its energy-as-a-service technology. UgoWork provides cloud-managed lithium-ion batteries and vehicles, allowing operators to outsource and optimize their energy and vehicle management. The funding will allow UgoWork to expand global distribution and accelerate product development.

FigBytes (Ottawa, ON) raised $19.8M in funding for its ESG insights platform. FigBytes helps companies monitor and report on their sustainability commitments. The funding will allow the company to grow sales, marketing and product development.

E3 Lithium (Calgary, AB) received $27M from the federal government to expand its lithium extraction operations and technology. The funding will allow E3 to develop technology that can extract lithium from depleted oil wells.

Miovision Technologies (Kitchener, ON) received $7.4M in funding from FedDev Ontario for its traffic management software. Miovision helps cities reduce congestion and emissions by monitoring and optimizing traffic controls. The funding will fuel product development and expansion into smart cities technology.

Avatar Innovations is launching a new, $3M fund for decarbonziation tech. The new fund builds on Avatar’s accelerator, allowing them to invest in tech that comes out of their program.

Bullfrog Power (Toronto, ON) was acquired by Envest, a Toronto-based independent energy producer, for approximately $35M. Bullfrog provides green energy through power-purchase agreements and renewable energy certificates.

Milestones & Growth

ARC Clean Technology’s small modular reactor (SMR) will power New Brunswick’s Belledune Port Authority, providing energy for the port’s Green Energy Hub.

Vancouver’s First Hydrogen will develop its first green hydrogen ecosystem in Shawinigan, QC. The facility will include sites for producing green hydrogen and assembling First Hydrogen’s zero-emission vehicles.

Canada’s Ocean Supercluster and Marine Renewables Canada launched a new partnership to share knowledge and advance marine renewable energy.

The first BrightDrop electric delivery van was delivered at GM's CAMI plant in Ingersoll, ON. The plant was recently converted to focus on producing electric vehicles.

In the news

Canada has a new climate adaptation strategy backed up by $1.6B over the next five years to get the ball rolling. The strategy will include targets for preventing or mitigating the worst effects of climate change, including extreme heat, species loss, flooding and wildfire protection.

The federal government started consultations for its new hydrogen and clean technology tax credits. The consultation will help determine the tax credits available for different levels of carbon intensity in hydrogen fuel.

Two new federal programs will focus on accelerating medium- and heavy-duty EV adoption: The Green Freight program offers grants up to $250K to support fleet assessments and retrofits. The Zero-Emission Vehicle Awareness Initiative focuses on building awareness and confidence in fleet owners to support adoption. Both programs are accepting applicants until Dec 12th.

B.C. announced $11.5M in funding to connect Vancouver International Airport with climate tech companies in the province that can help decarbonize its operations. The program will help meet the airport’s net-zero targets while also creating domestic customers for local innovators.

The Ontario government launched a new, $5M fund to accelerate research and development in the province’s critical minerals sector. The fund focuses on building the clean technology supply chain as the province continues to invest in its EV supply chain strategy.

Volkswagen is considering Canada as the location of its next battery cell factory, kicking off the official search. While not a firm commitment, the search builds off of prior agreements with the Canadian government earlier this year.

The Ivey Foundation, a private foundation focused on the intersection of climate change and the economy, will disburse its full $100M endowment in the next five years. The foundation pointed to the urgency needed to address climate change as the driving factor in their decision.

The oil and gas drilling industry is asking the feds for a new, 50% tax credit to help decarbonize their operations and meet Canada’s 2050 net-zero commitments. Part of the claim is a lack of capital interested in the industry and several years of low oil prices.

What’s going on

✏️ Are you a climate tech founder or investor? Climate Tech VC wants your feedback on the current state of the market in their Market Sentiment Survey. The results will be shared before the end of the year to help climate builders understand the state of the market and do their best work.

🏆 Foresight Canada released their Foresight 50 list of Canada’s “most investable” climate tech companies. Check out the full list here.

📅 EV Innovation & Technology Conference: Hosted by Electric Autonomy Canada, the conference will bring together Canada’s EV manufacturing ecosystem. Feb 8, 2023 in Toronto.

Jobs

Hand-picked jobs from some of Canada’s most interesting climate tech companies. Have a role to post? Drop me a line.

Head of Business Development at Clir - Vancouver, BC

Manager, Data Analytics at GoBolt - Remote

Lead Cloud Engineer at Audette - Remote

Business Development Lead at Wyvern - Edmonton, AB

Ocean Technology Developer at Planetary - Dartmouth, NS

People Operations & HR Manager at Salient Energy - Dartmouth, NS

That’s all for this week. As always, thanks for reading and if you’re enjoying the newsletter, consider sharing with a friend!

Justin