Hey there,

Welcome to another issue of Climate Tech Canada! In this week’s issue we take a look back at climate funding in Q1 and see how trends have shifted since last year. We also take a look at the wider Canadian venture landscape and climate tech globally.

We’ve also got a new raise for energy management platform Peak Power, a Series B for Novisto’s ESG software solution, plus Seed rounds in ag-tech and circular packaging.

Elsewhere in climate, we have several new investments in lithium to build out Canada’s EV supply chain, Saskatchewan delays reaching a net-zero grid, and Ontario bets on energy storage to manage growing demand. Let’s go!

A look back at Q1

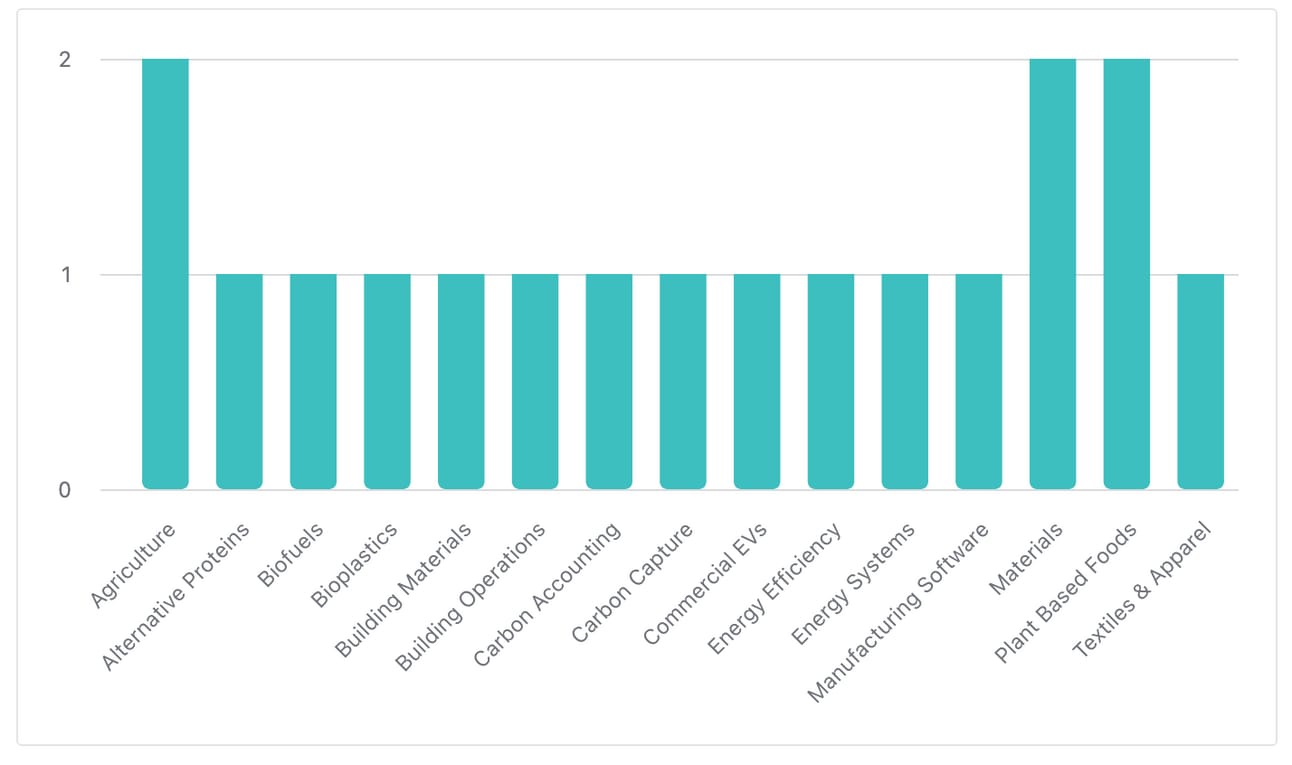

I’ve been tracking funding rounds since I started writing this newsletter, and wanted to take a look back to see what kinds of trends are emerging. Notably, 2023 had a rocky start across the board, with venture funding in Canada returning to pre-pandemic levels. Here’s what we saw in Q1/23 and how it stacks up vs the year before:

Q1/23 saw 18 rounds totalling more than $351M raised. This included two rounds over $50M: Summit Nanotech’s $67.4M Series A and No Meat Factory’s $56M Series B. We’re looking exclusively at venture & growth funding here, and these numbers don’t include other funding sources like government grants, strategic investments or project funding.

Looking year-over-year, venture capital invested in climate declined by 60% vs Q1 of last year. Q1/22 saw $652M raised across 10 rounds, driven mainly by large rounds like Assent Compliance’s $350M Series D and Lithion Recycling’s $125M Series A.

Average deal size dropped by more than a third, from $65M in 2022 to $20.6M in 2023

Digging Deeper

By sector, Agriculture & Food led the way with five rounds across ag-tech and alternative proteins totalling $125.2M.

Quebec and B.C. saw the greatest investment with $102M and $100M respectively, while Ontario saw the most rounds at 9.

Seed rounds were the most common, followed by Series B and unspecified venture funding.

The most active investors were EDC and Cycle Capital followed by Idealist Capital, Climate Capital and Blue Vision Capital.

In terms of new venture funds, SVG Ventures announced its new $75M Thrive Agrifood fund and Evok Innovations secured $10M USD for its second fund.

Wider Trends

The drop in climate funding this year mirrors the global climate tech landscape. According to Pitchbook, climate attracted $5.7B across 279 deals globally, a decrease of 35% YoY and the lowest quarter since 2020. Between a down market and banks like SVB running into trouble, it’s been a tough environment to raise capital.

While Canada’s 60% decline in climate funding may sound dire, it’s less than the 82% decline that Canadian venture funding as a whole experienced in Q1. Canadian climate also saw an 80% increase in total number of deals, while the wider industry saw the number of deals decline by 67%.

We’re looking at a fairly small number of rounds in a single quarter, so changes can look more dramatic and should be taken with a grain of salt. Generally speaking though, Q1 could be summed up as a) a slowdown in deployed capital, b) a shift to more, yet smaller, rounds and c) a greater focus on fundamentals and efficiency.

💰 Funding

Peak Power (Toronto, ON) raised $47M to expand its energy management solutions into the U.S. Peak Power’s software helps commercial users reduce operational costs and emissions while also selling energy back to the grid. The funding will be used to expand in the U.S. as the Inflation Reduction Act spurs growth of energy storage.

Novisto (Montreal, QC) secured $27M in Series B funding for its ESG software. Novisto helps companies manage their ESG data, comply with emerging sustainability disclosure requirements, and evaluate their own performance. The funding will be used to drive product development and expand globally.

Friendlier (Guelph, ON) raised $2.3M in seed funding for its reusable packaging solution. Friendlier replaces single-use packaging for food service providers with reusable containers that customers return to claim their deposit. The funding will be used to expand nationally, seizing the opportunity presented by the federal single-use plastics ban.

Picketa (Fredericton, NB) closed a $1.4M seed round for their plant tissue analysis software. Picketa’s tissue analysis gives farmers real-time insight into how crops are absorbing nutrients, enabling them to optimize inputs and reduce emissions. The funding will be used to deploy Picketa’s technology in Canada and the UK.

dcbel (Montreal, QC) secured a strategic investment from the Volvo Cars Tech Fund for its bidirectional EV charging technology. dcbel’s Home Energy Station uses plugged in EV batteries to power homes during peak demand, reducing grid demand and even generating revenue for individuals by selling power back to the grid.

Stromcore (Mississauga, ON) received $4.8M to support production of their intelligent lithium batteries for forklifts.

Five projects took home a total of $300K at the Climate Solutions Festival—Quebec. Winners included:

NovoPower International - converting waste heat into energy for data centres

Opalia - animal-free dairy made with mammary cells, reducing methane emissions and land use

Altiro Energy - iron-based large-scale energy storage

📈 Milestones & Growth

Lufa Farms opened its first indoor farm in a former Sears distribution centre. Lufa operates a closed loop greenhouse and sells directly to more than 30,000 customers.

Electra Battery Materials is partnering with Three Fires Group to develop a lithium battery recycling venture. Three Fires is an economic development group for the Anishinabek Nation.

🌎 In the news

NATIONAL

Canada and South Korea will co-operate on supply chains for critical minerals, the latest in a string of similar agreements as countries look to diversify their EV supply chains.

Canada is partnering with the U.S. on a new cross-border corridor of charging stations that will run from Michigan to Quebec City. The corridor was one of the goals agreed to by President Biden and PM Trudeau during the president’s visit to Ottawa earlier this year to drive EV adoption.

The feds announced $5.9M in funding for organizations to boost awareness of zero-emissions vehicles. NRCan also announced around $25M to help organizations install more than 3,300 new EV chargers, mostly in Ontario.

The federal government also announced $3.6M to support the Efficient Trucking Program in Manitoba, alongside $3.3M from the Manitoba government. The program provides rebates to install fuel-saving devices or tech for heavy-duty vehicles.

The bodies governing offshore energy in Nova Scotia and Newfoundland and Labrador have a new focus on renewables. The feds updated their mandate from “Offshore Petroleum” to “Offshore Energy” in an effort to better support offshore renewable energy development.

The federal government also announced $4M to support a net-zero roadmap for Saint John Energy, part of their goal to transition to a national net-zero grid by 2035.

PROVINCIAL

GM will build a new factory to produce cathode material in Becancour, QC. The announcement comes with $300M in support from Quebec and the federal government.

Nemaska Lithium signed a deal to supply Ford Motors with lithium hydroxide for its EV batteries over 11 years. Nemaska is also based in Becanour, QC.

Across the border, Ontario is building out its own mineral supply chain as Frontier Lithium announced a lithium hydroxide plant near Sudbury, ON. Securing lithium hydroxide production has been a focus for the Ontario government.

Ontario’s energy operator announced the province will quadruple it’s energy storage capacity with seven new projects totalling 739 mW, part of an effort to meet growing demand.

South Korea’s SK Group will invest $50M USD in a wind-to-hydrogen project in Newfoundland and Labrador led by NL-based World Energy GH2.

Saskatchewan announced a goal to reach net-zero energy generation by 2050, 15 years later than the federal target. Premier Moe has critiziced the federal goal of 2035 as “impossible”, while others have argued that connections with MB hydro power and the impacts of climate change make the switch realistic and necessary.

🔭 Here & there

How Ontario and Quebec are vying for lithium dominance as Canada expands its EV supply chain.

A new report from RBC looks at the climate costs and opportunities in fixing Canada’s housing crisis.

Reduce, reuse, reimagine: the Canadian startups remaking the motor.

How Flashfood reinvented the discount food rack.

Investment in clean energy is outpacing fossil fuels, and solar is set to pass oil production for the first time according to the IEA.

Quantified: Researchers have drawn a measurable link between a number of oil companies and recent extreme wildfires in North America.

A look back at carbon removal’s record-setting 2022.

📣 What’s going on

📅 Earth Tech Demo Day: Virtual pitches from the Foresight Earth Tech accelerator, featuring fleet electrification, agriculture sustainability, water conservation, and more. June 22nd.

📌 Jobs

Featured postings from some of Canada’s most innovative companies:

🐟 Lead Food Materials Scientist at New School Foods - Toronto, ON

🏗️ Manager, Engineering at Nexii Building Solutions - Vancouver, BC

🌡️ Director of Industry Partnerships at Mysa - Remote

⚡️ HR Coordinator at Moment Energy - Coquitlam, BC

🚚 Customer Support Operations Analyst at GoBolt Logistics - Toronto, ON

That’s all for this week. If you have any feedback on this week’s issue, drop me a note by hitting reply. And if you’re enjoying the newsletter, share it with a friend!

Justin