Hey there,

Welcome to this week’s issue of Climate Tech Canada, where we break down the latest in climate tech.

I published a new episode of The Climate Cycle last week featuring Dr. Vida Gabriel, co-founder and COO of TerraFixing. They’re a direct air carbon capture startup based out of Ottawa focused on cold-climate carbon removal. It was an enlightening conversation and I shared a few of my top takeaways over on LinkedIn.

This week in climate tech:

Canada’s first set of clean tech tax credits arrive

AlumaPower raises $13.7M to turn scrap metal into energy

New greenwashing laws go after weak sustainability claims

TECH

Turning scrap metal into clean energy

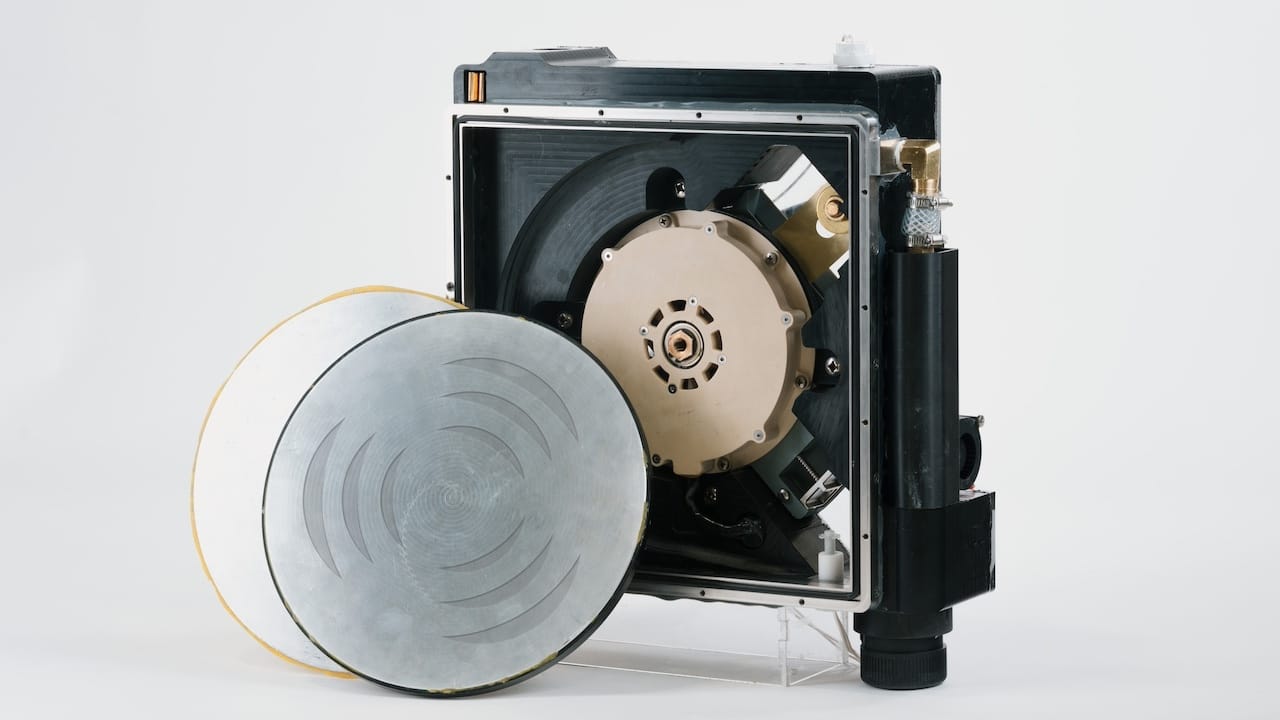

Source: AlumaPower

What happened: AlumaPower closed an oversubscribed $13.7M (US$10M) Series A round for their aluminum-air energy source.

AlumaPower is developing a Galvanic Generator, a long-duration, portable and zero-emissions energy source that uses scrap aluminum as fuel. The system has a similar structure to a battery, using aluminum discs which oxidize in a water-based electrolyte and an air-breathing cathode.

The problem: When the grid isn’t accessible, diesel is often the only alternative. AlumaPower wants to replace diesel generators with their Galvanic Generator in off-grid locations like remote communities, film sets, or when EVs need to extend their range.

The solution: Metal-air batteries have been around since the 1960s but faced a number of technical limitations that stopped them from scaling. AlumaPower believes they’ve found a solution by using rotating aluminum discs to mitigate corrosion and wear, while also allowing them to use recycled aluminum as a fuel source.

Aluminum has many advantages - it has one of the highest energy densities of all battery chemistries and the fuel is stable and easy to transport, with solid supply chains already in place. Making aluminum requires a lot of energy, but using recycled scrap material - like old cars, airplanes and cans - can keep lifecycle emissions low. In fact, AlumaPower claims about 86% lower emissions than diesel generators.

What’s next: AlumaPower is pivoting from an R&D focus to real-world pilots with customers. The funding will be used for product demonstrations with logistics customers and to build out new solutions for EV range extension and marine propulsion.

CLIMATE CAPITAL

💰 Raven Indigenous Outcomes Funds secured $20.4M in an initial close for its new fund focused on tackling climate and health issues in Indigenous communities. The fund is targeting a final $50M close. The fund will use Community-Driven Outcomes Contracts to bring together various stakeholders to address specific challenges and achieve set outcomes.

🔧 LiftWerx closed an equity investment from TowerBrook Capital Partners for an undisclosed amount. LiftWerx provides operations and maintenance services to onshore wind farms.

MILESTONES & PRODUCT

♻️ Cyclic Materials, a rare earth element recycling company, will sell its recycled materials to rare earth supplier Solvay.

🏆 Resolve Composites (recycling large-scale composite structures) and Net Zero Edge (ocean-cooled data centres) took home first place and $50K each at the Spark Nova Scotia pitch competition.

🌳 Carbon project developer Carbonethic teamed up with Dease River First Nation to use AI and remote sensing to generate removal and avoidance credits for a 2.7 million acre forest project.

🔋 Northvolt North America partnered with Concordia University’s Volt-Age program for joint research on lithium and sodium batteries as well as industrial and professional training.

NEWS

Clean investment tax credits arrive

Source: Obert Madondo

The federal government passed four of Canada’s long-promised clean tech investment tax credits (ITCs). The credits have been in the works since first being announced in Budget 2021 as a response to the US Inflation Reduction Act. The newly minted tax credits include:

Carbon Capture, Utilization and Storage

Clean Technology

Clean Hydrogen

Clean Technology Manufacturing

Companies can claim 15-40% of their investments under the tax credits. They’re also refundable, which means companies can receive cash if the credit exceeds their tax bill.

Why it matters: The tax credits help level the playing field between Canada and the US and generate more domestic demand for climate tech. The billions in incentives available through the US Inflation Reduction Act (IRA) made a compelling case for Canadian climate tech ventures to move stateside. Now, two years later, Canada is well positioned to attract more investment.

Stacking up: Canada’s incentives are smaller compared to the IRA - about $80B over the next decade vs close to $400B in the US. The IRA also favours production tax credits, which help with “bankability” or long-term certainty for capital planning. However, Canada’s use of Carbon Contracts for Difference through the Canada Growth Fund could provide a similar level of certainty, assuming these are made more widely available.

The ITCs also have some gaps in which technologies are eligible. For example, the CCUS credit applies to direct air capture with geologic storage but not to other forms of carbon removal. The manufacturing credit doesn’t apply to manufacturing carbon removal technologies.

What’s next: Companies can now apply for the Clean Tech and CCUS credits, with applications for the other two available in the fall. Tax credits for Clean Electricity are planned for later this year and the EV Supply Chain tax credit in 2025.

IN THE NEWS

👮🏻 Exaggerated claims: The feds introduced tougher rules to tackle greenwashing. Companies can’t make claims about a product or business’ ability to protect or restore nature without being based on a “proper test”. The onus is also now on those making the claim to show they have evidence. The change spooked the oil industry - the Pathways Alliance, an oil lobby group, scrubbed its entire website.

🏛️ Forever lawsuits: The B.C. government filed a class-action lawsuit against the makers of PFAS or “forever chemicals”. The lawsuit targets 12 companies including 3M, BASF and DuPont, and claims the companies knew their chemicals would pose health risks and linger in the environment for centuries. There have been several lawsuits in the US. The largest will see 3M pay out more than $10B.

🏗️ Accelerating big projects: A working group of federal Ministers published a plan for getting clean growth projects built faster. The action plan includes a central permitting coordinator to get major projects done within five years, stronger consultation with Indigenous communities and better collaboration with provinces. The mining industry has been particularly vocal about the need for faster assessments.

🔋 Tariffs on the way: Canada will join the US and EU by introducing tariffs on Chinese-made electric vehicles. The feds have been under pressure from allies, provincial governments and the Canadian auto industry to push back against unfair competition. It’s not clear how much impact higher tariffs will have - most Chinese-made cars are Teslas as opposed to Chinese brands.

⚛️ Uranium takeover: Canadian mining company Fission Uranium will be acquired by Australia’s Paladin Energy for $1.14B. The deal is largely driven by Fission’s Saskatchewan uranium project, “one of the great undeveloped deposits” in the world. Uranium prices are expected to climb as much as 28% by 2030 as more countries pursue nuclear energy to lower emissions.

BIG PICTURE

Major conservation groups are calling for SBTi to allow the limited use of high-quality carbon credits.

Insurance broker Howden Group introduced the world's first warranty and indemnity policy for carbon credits to boost trust in carbon markets.

The EU adopted a landmark nature restoration law to restore 20% of threatened ecosystems by 2030.

Google is pioneering a “clean transition tariff” to help utilities pay for emerging technologies without increasing consumer rates.

BMW cancelled a $2B battery cell order from Northvolt due to missed order deadlines.

The US passed a sweeping new bill to accelerate nuclear energy deployment.

COMMUNITY

📅 The Canadian Climate Investor Conference: Hosted by Toronto Stock Exchange and TSX Venture Exchange, this conference brings together growth-oriented clean tech and renewable energy companies and investors. June 25th, Toronto.

💡 RBC Women in Cleantech Accelerator: Powered by MaRS, the accelerator supports 7-10 women entrepreneurs for a two-year program to advance breakthrough ideas. Apply by July 19th.

📌 VP of Sales at Planetary: Protecting and restoring the ocean and climate for generations to come through ocean-based carbon removal and storage. Own Planetary’s revenue engine including credit sales and market infrastructure in voluntary and compliance markets. See more open roles.

Thanks for reading! If you enjoyed this issue, help us reach more people by sharing it with someone in your network. And if you’re that someone, subscribe here.

Thanks for reading,

Justin

WORK WITH US

Want to get in front of 450+ climate tech founders, investors and tech operators? Get in touch [email protected]