Hey there,

Today we’re sharing our recap of climate tech funding from the first half of the year.

2025 got off to an interesting start to say the least. VC investment in climate tech looked like it was on track to stabilize and maybe even start to recover after a major slowdown in 22/23.

But tariffs, global conflict, and an about-face on climate policy in the US had other plans.

We’ll take a look at the high level funding numbers, how different sectors and stages are faring, and how global conflict and uncertainty is changing the climate investing landscape.

A quick preview of what’s in this deep dive:

$440M raised in the first half of 2025, down 31% from last year

A focus on energy and critical minerals

A split between Seed and Growth rounds while the gap in between continues

How global conflict and uncertainty is changing the climate investing landscape.

📝 A quick note about the data before we dive in: It’s a small dataset based off of public announcements. Take it with a grain of salt.

I hope this data sparks some conversations - If you’re interested in building on this dataset or want to talk about the numbers, hit reply or email me at [email protected].

P.s. New here? Sign up for our weekly newsletter to get the latest news, milestones and trends in Canadian climate tech

At a glance

After signs of recovery in 2024, funding for Canadian climate tech slowed again in the first half of 2025, reflecting economic pressures and political uncertainty.

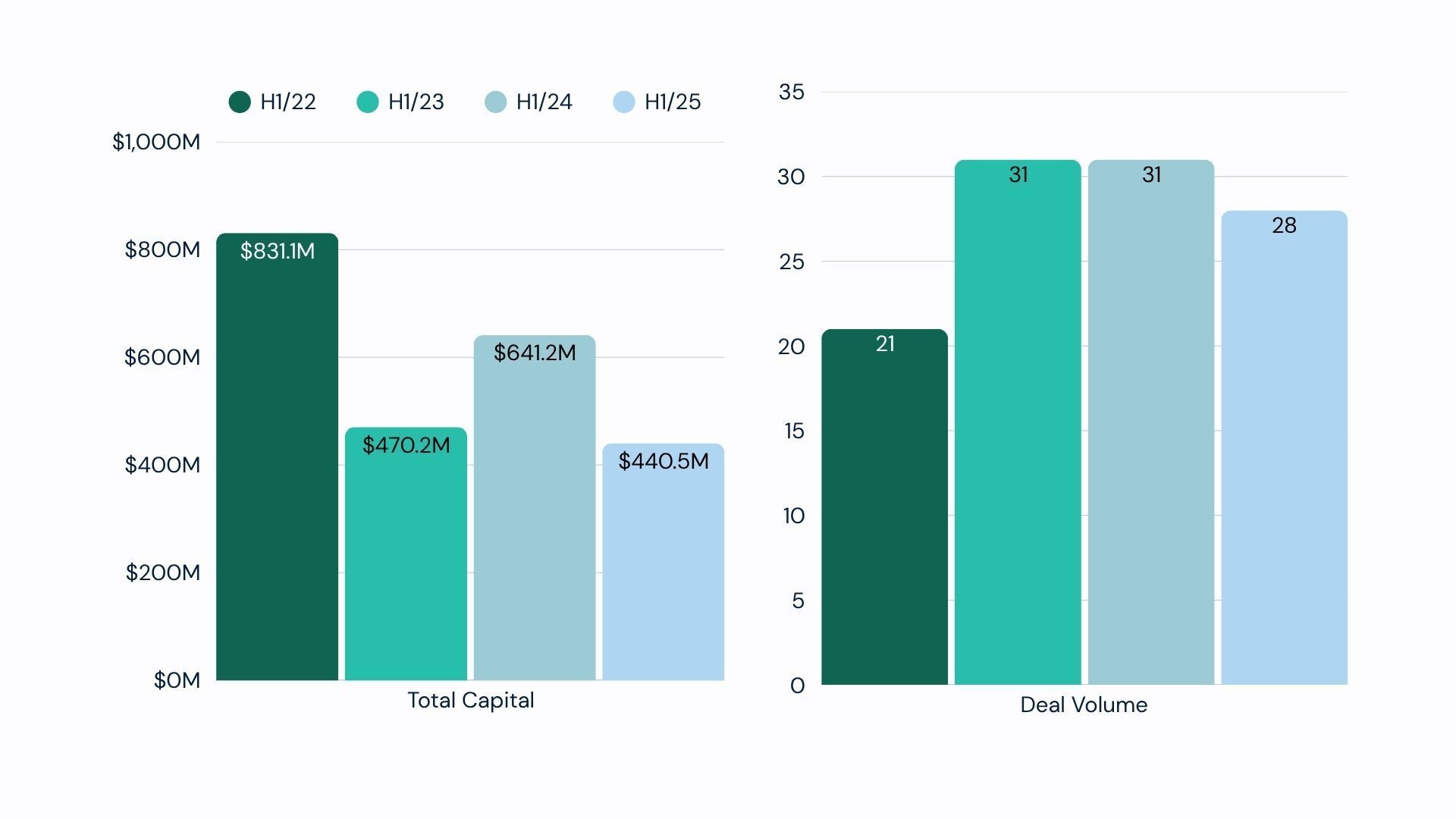

Canadian climate tech startups raised just over $440 million across 28 deals in the first half of 2025, a 31% drop from the $641 million raised during the same period last year. While the number of deals slowed slightly, average deal sizes held steady year-over-year at around $20 million. But deal sizes are still down (about half) from the highs we saw ‘21/’22.

Policy uncertainty, trade tensions with the US, and ongoing economic pressures all contributed to a slow start to the year. In 2024 we saw the market correct from the ‘22-’23 hype cycle, but then recovery got sideswiped by these political shifts.

Total funding is in line with what we saw in 2023 when high interest rates and an economic downturn hit the market

Notable rounds in the first half of this year include Eavor (geothermal) and dcbel (distributed energy), both led by the Canada Growth Fund. Summit Nanotech and Mangrove Lithium also closed growth rounds for their critical minerals extraction tech.

The Details: Stage & Sector

Early stage: Activity at the Pre-Seed and Seed stages slowed down slightly, but the median Seed round climbed to $4.9M from about $3.9M last year. There’s still a willingness to place early bets on emerging tech.

Series A activity: We tracked just three Series A deals in the first half of 2025, as investments at this critical stage continue to slow down. This gap isn’t new, but it’s getting more pronounced and could limit ventures’ ability to scale pilots into commercial projects.

Growth stage: Growth rounds accounted for nine deals, with an average size of $58 million. Companies like Eavor (geothermal), dcbel (distributed energy), Mangrove Lithium, and Summit Nanotech (critical minerals) secured significant capital to scale up, often with support from the Canada Growth Fund - which is becoming a key player in de-risking late-stage investments

Sector Highlights:

Energy: Energy leads the way with 64% of total capital raised. This included geothermal, battery storage, grid utilities, and distributed energy.

Critical Minerals: Made up 20% of total funding, and reflecting the strategic value in securing battery value chains.

Adaptation & Regeneration: While still a smaller slice of the pie, interest is growing in adaptation and regeneration tech like Verdi (smart irrigation) and Xatoms (water purification).

New here? Sign up for our weekly newsletter to get the latest news, milestones and trends in Canadian climate tech 🇨🇦

The Global Context

Canada has weathered global swings in climate investment better than most, with less dramatic funding declines. This year, that resilience is showing signs of strain.

According to CTVC, global climate investment also declined in H1/25, but only by 19% (vs Canada’s 31%). The underlying dynamics are similar, though: Fewer deals, fewer large investments, and a more selective environment.

The US continues to attract outsized capital (51% of global investment) but actually deploying may get harder (particularly for emerging tech) as policy supports and public funding get pulled back.

Canada is well-positioned as a place to build and deploy climate tech, but needs more capital and urgency to seize the moment.

Globally, debt is now the most dominant form of non-dilutive capital, backing scalable, infrastructure heavy solutions with clear market fit. It’s a sign of growing confidence in the commercial viability of climate tech and a maturing ecosystem.

What We’re Watching

As we move into the second half of the year, here are some dynamics to keep an eye on:

Series A activity: The gap at Series A could leave promising ventures without the capital they need to grow, and stalling out the next generation of scale-ups.

Project acceleration: Canada’s focus on speeding up permitting and advancing industrial policy could speed up project timelines and attract more investment, particularly in infrastructure, industry and energy. Financing structures beyond just VC will be critical in making the leap.

Security: Energy, economic, supply chain and old-fashioned military are all stepping into the spotlight. Between trade wars, diversifying supply chains away from China, and a new commitment to NATO spending, we could see all facets of security get more attention.

Diversifying markets: More collaboration with the likes of the UK, EU and Asia to pivot away from relying on the US and tapping into new markets.

Seizing the moment: Tariffs and trade disruptions are impacting the Canadian market, but a window of opportunity is opening as the US walks back its climate policy and public funding. Canadian investors and corporates can seize that opportunity to invest, deploy, and take a leadership position.

I’d love to hear from you - what trends are you watching in the back half of the year? Are there other data points you’d like to see us cover?

Hit reply or email me at [email protected] to let me know

Appendix

Our data is based on public fundraising announcements. Some raises (e.g. extensions, bridges, and pre-seed rounds) are unreported and won’t show up here.

It’s also a small data set, so the inclusion / exclusion of one data point can skew the results, particularly when we look at averages. I’ve called this out where possible.

Verticals: Broadly, I consider climate tech to be companies creating technology that is intentionally reducing emissions, adapting to climate change, or helping monitor and quantify climate impact. I lean on Climate Tech VC’s classifications for Vertical and Industry.

Share Climate Tech Canada with your network and help us grow! Make {{ rp_num_referrals_until_next_milestone }} referrals to get a {{ rp_next_milestone_name }}. See all rewards here.